how much does a tax advocate cost

100 Money Back Guarantee. Achieve Your Goals By Using The Right Services Subject Expertise For Your Business.

Why You Can T Reach A Real Person At The Irs The Washington Post

The Private Letter Ruling PLR fee increased from.

. The Board of Elections put the cost of running the contest at 15 million. How much does it cost to take a vacation. How much does it cost to buy tax software.

Ad Honest Fast Help - A BBB Rated. According to the National Association of Accountants the average cost for a tax professional to complete your taxes ranges from 176 to 27. The Council On State Taxation COST and the State Tax Research Institute STRI are pleased to announce the.

You definitely arent out of options. For both commission and fixed fee there is typically a retainer that is charged up front which can vary between 3K and 5K depending on the budget of the client. Please dont translate that to mean that an advocate will cost you a few thousand dollars.

Feature 2021 State and Local Business Tax Burden Study October 22 2021. 0 Federal 0 State 0 To File offer is available for simple tax returns only with TurboTax Free Edition. In addition to professional tax representation there is a free IRS taxpayer advocate service TAS which may be able to help taxpayers resolve tax debt.

Most major tax apps. We make a difference in peoples. Ad Honest Fast Help - A BBB Rated.

Her services mightand even so that might be a bargain. Individual Tax Return Joint Tax Return Married Separate Tax Return Your Part D Monthly Premium 2021 88000 or less. The service doesnt cost anything but you must be.

We protect the rights of every taxpayer who comes to us and advocate on behalf of all taxpayers by working to simplify and reduce the burden of the tax code. The Taxpayer Advocate Service also can pinpoint and offer you resolutions to problems that are not only happening to you but happening to many other taxpayers as well. The Taxpayer Advocate Service TAS helps people resolve tax issues with the IRS.

It might cost you 200. Tax software can range in cost from free to around 200 depending on the software you choose and your specific needs. And with such an enormous field of candidates CFB has set aside up to 8 million to dole out in public.

How much more can I make if I get a new job. The charges will vary dependent on all of the above. Or it could be that your.

Optima Tax Relief assigns you a. The IRS states that The Taxpayer. Think about those questions for a minute.

What comes after that is less certain in terms of price fees range from 995 to 5000 on average and vary case by case. The National Taxpayer Advocates 2015 Annual Report discussed problems with a wide range of user fees. An independent private health or patient advocate charges for his or her services.

The Taxpayer Advocate Service is an independent organization within the IRS whose employees assist taxpayers who are experiencing economic harm who are seeking. Who does the work. Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time.

100 Money Back Guarantee. What does it cost to go to college. The standard contingency fee set by congress states that Advocates are limited to 25 of the past-due benefits paid to the claimant and any beneficiaries on his or her account up to a.

How much does TurboTax free edition cost.

The Irs Is In Crisis Taxpayer Advocate Warns Of 2022 Refund Delays

I Made A Mistake On My Taxes Taxpayer Advocate Service

Where S Your Refund Veteran Taxpayer Advocate Offers Tips On Dealing With The Mess At The Irs

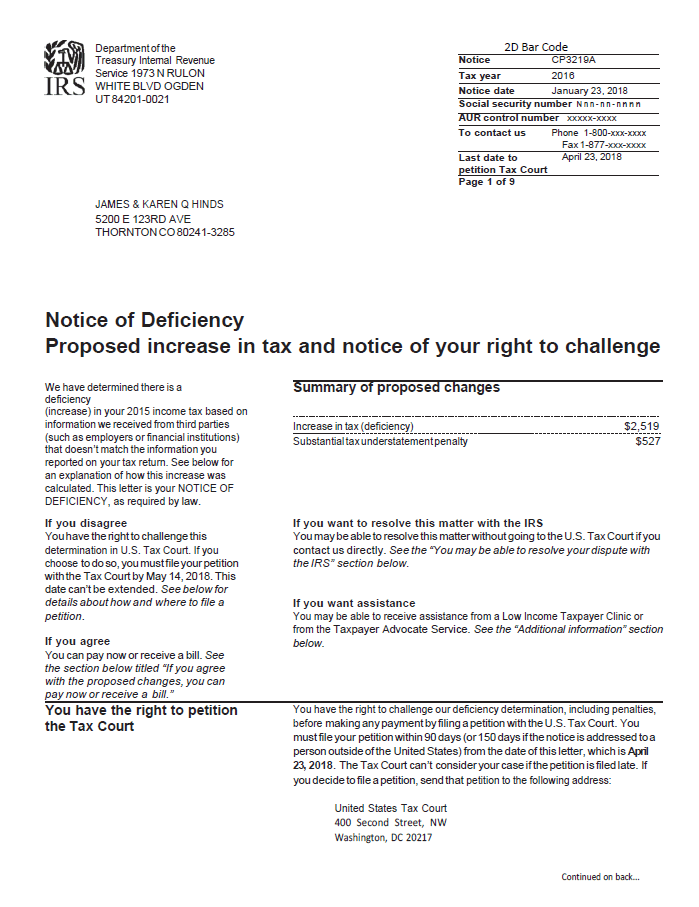

Notice Of Deficiency Overview Irs Forms Options

What Does The Irs Do And How Can It Be Improved Tax Policy Center

Home Taxpayer Advocate Service Tas Taxpayer Advocate Service

About Us Taxpayer Advocate Service

Irs Taxpayer Advocate Service Local Contact Hours Get Help

Irs Halts Plans To Close Processing Center Amid Substantial Backlog Accounting Today

Irs Letter 2904 Request For Information H R Block

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

Tax Tip Notice From Irs Something Is Wrong With 2021 Tax Return Tas

![]()

Our Leadership The National Taxpayer Advocate Erin M Collins

How To Become A Tax Consultant

Irs Delays Will Be Extraordinarily High Again Warns The Agency S Taxpayer Advocate

The Irs Is In Crisis Taxpayer Advocate Warns Of 2022 Refund Delays

What Does The Irs Do And How Can It Be Improved Tax Policy Center